Top Service News

📊 Insolvency Statistics Update – May 2024

Published on

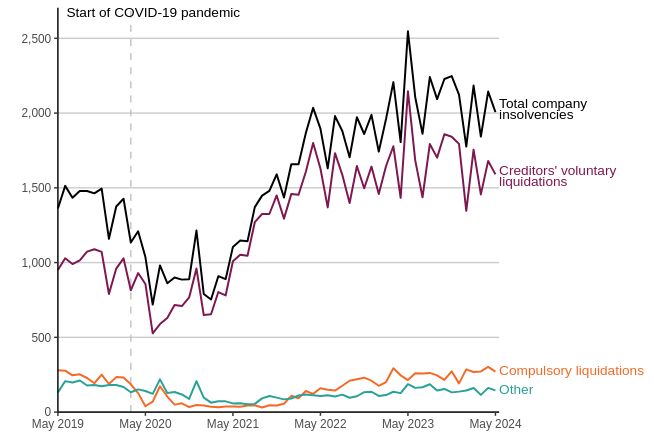

The Insolvency Service has released the latest figures for May 2024, providing a comprehensive overview of the insolvency landscape in the UK.

Company insolvency dropped 6% compared to April 2024 but insolvency remains higher than those seen during Covid-19 and between 2014 – 2019.

📈 Overview of Registered Company Insolvencies

In May 2024, a total of 2,006 company insolvencies were recorded. The breakdown is as follows:

- 📉 1,590 Creditors’ Voluntary Liquidations (CVLs)

- 🚫 271 Compulsory Liquidations

- 🏢 126 Administrations

- 📄 19 Company Voluntary Arrangements (CVAs)

📅 Yearly Comparison: May 2024 vs. May 2023

When comparing May 2024 to the same month in the previous year, a significant trend emerges. There has been a 21% decrease in the total number of insolvencies, with May 2024 witnessing 541 fewer cases than May 2023.

📊 Changes in Insolvency Types Year-on-Year:

- 🚫 Compulsory Liquidations: Increased by 27%

- 📉 Creditors’ Voluntary Liquidations: Decreased by 26%

- 🏢 Administrations: Decreased by 20%

- 📄 Company Voluntary Arrangements: Decreased by 37%

This yearly comparison indicates a mixed trend in insolvency types. While compulsory liquidations have surged, other types of insolvencies have notably decreased.

📆 Month-on-Month Comparison: April 2024 vs. May 2024

Examining the month-on-month data reveals a slight decrease in insolvency cases from April to May 2024. Specifically, there was a 6% decrease, equating to 138 fewer cases in May compared to April.

📉 Month-on-Month Changes in Insolvency Types:

- 🚫 Compulsory Liquidations: Decreased by 10%

- 📉 Creditors’ Voluntary Liquidations: Decreased by 5%

- 🏢 Administrations: Decreased by 13%

- 📄 Company Voluntary Arrangements: Increased by 6%

UK construction insolvencies remain at elevated levels but there are signs the numbers are beginning to level out, demonstrating the industry’s resilience & adaptability

The fact remains that credit management teams across the industry must remain vigilant and continue to look for the most valuable tools and information available to them. To understand more about how we can help you minimise risk and maximise cash flow, call in to speak with one of our experts today on 01527 518800.