Economic Crime and Corporate Transparency Act: Objectives, Changes, and Compliance Requirements

The Economic Crime and Corporate Transparency Act aims to enhance data accuracy on company registers to combat economic crime and boost confidence in the UK economy. It introduces new objectives and powers for the Registrar of Companies, including ensuring document compliance, accurate register information, and preventing unlawful activities

Purpose of the Act:

The Economic Crime and Corporate Transparency Act aims to improve data accuracy on company registers, combat economic crime, and increase confidence in the UK economy.

Registrar’s New Objectives:

- Ensure all required documents are submitted and properly delivered.

- Maintain accurate and complete information on the register.

- Prevent misleading public records.

- Prevent companies from engaging in or facilitating unlawful activities.

Key Changes:

- Registered Office Addresses:

- Companies must have an “appropriate address” as their registered office, ensuring documents reach the company and can be acknowledged.

- Non-compliance could lead to the address being changed to a default address at Companies House, with potential strike-off if not rectified within 28 days.

- PO Boxes and equivalent services cannot be used as registered office addresses.

- Statement of Lawful Purpose:

- New companies must confirm they are formed for a lawful purpose.

- Companies must confirm their intended activities are lawful in their annual confirmation statement.

- Registrar’s Enhanced Powers:

- Ability to query and remove incorrect or fraudulent information more quickly.

- Stronger checks on company names to prevent misleading impressions.

- Use of annotations and data matching to clean up the register.

- Introduction of a new identity verification process.

Enforcement and Sanctions:

- Failure to comply with requests for information may result in financial penalties, annotations on records, or prosecution.

- Companies with inappropriate registered office addresses face similar consequences, including potential removal from the register.

Read more about the new statutory objectives for the Registrar of Companies here: https://changestoukcompanylaw.campaign.gov.uk/improving-the-quality-of-data-on-our-registers/?utm_content=&utm_medium=email&utm_name=&utm_source=govdelivery&utm_term=

Philip King FCICM Joins Top Service Ltd: An Exclusive Interview with CEO Emma Reilly FCICM

Philip King FCICM, a renowned figure in credit management, recently joined Top Service Ltd, drawn by the company’s exceptional team and supportive environment. Philip describes Top Service in three words: Passionate, knowledgeable and committed.

Retention of Title Webinar – Weds 4th September 2024

Retention of Title (ROT) clauses can provide essential protection for credit managers in the construction industry, but navigating their complexities and limitations is crucial.

Join us on 4th September, 10:00 AM – 11:00 AM, for an in-depth discussion with our expert panel.

🎙️ Meet the Speakers:

Emma Reilly FCICM – CEO, Top Service Ltd. With 23+ years of credit management experience, Emma leads a team providing tailored solutions to the UK construction sector.

James Linton ACICM – Creditor Advisory Team Manager, PKF Littlejohn Advisory. James offers extensive support and technical advice to creditors, especially on ROT matters.

Philip King FCICM – Non Exec Director, Top Service Ltd. Philip brings a wealth of experience from his time as Chief Executive of the Chartered Institute of Credit Management and interim UK Small Business Commissioner.

Shaun Lowry LLB (Hons) MA MSC MCIArb – Head of Construction, Silverback Law. Shaun supports the writing and understanding of construction contract law.

Don’t miss this opportunity to gain insights from industry leaders and protect your business more effectively. Click Here to register: https://us06web.zoom.us/webinar/register/WN_mr5DbIZgRsag1xNpf2H9Sw

Emma Reilly, CEO – Message to Top Service Members

Emma Reilly, FCICM, CEO at Top Service Ltd & Credit Expert:

We’ve achieved a thrilling 16% increase in our trading experiences! Discover why sharing information is crucial to our success and get ready for some exciting announcements.

16% Increase In Trading Experiences From Top Service Members.

For the first 6 months of 2024, Top Service has experienced a 16% increase in trading experiences submitted by it’s members. Demonstrating the importance of sharing this type of information and the value the information holds for credit managers and anyone assessing risk levels in the construction industry.

Emma Reilly, CEO – Top Service Ltd said “this increase is significant especially when you think about the amount of trading experiences being shared via our platform every day. We are talking about an increase in the thousands.

There is an increased enthusiasm and recognition for the importance of sharing this type of information. Businesses and the people within those businesses are seeing the benefit of having access to this type of information and understand that the more information shared, the better protected everyone else is”.

“New members to our service, particularly over the past 6 months are mostly using other mainstream agencies but feel they are lacking the knowledge that our trading experiences bring to the decision making process’.

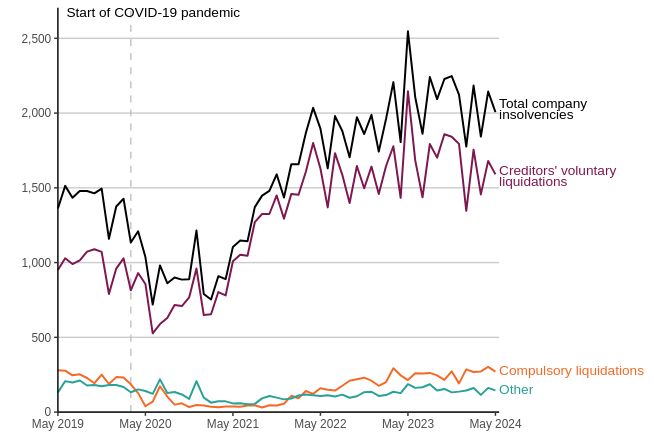

Company Insolvency numbers in June 2024 were higher than in May 2024.

The Insolvency Service has published the latest figures for June 2024, offering a detailed overview of the insolvency landscape in the UK.

Here’s a breakdown of the numbers:

Registered Company Insolvencies Breakdown:

- In June 2024, a total of 2361 company insolvencies were recorded, with the following distribution:

- 📈 1866 Creditors’ Voluntary Liquidations

- 🚫 302 Compulsory Liquidations

- 🏢 170 Administrations

- 📄 23 Company Voluntary Arrangements

📊 Creditors’ Voluntary Liquidations comprised 79% of the total company insolvencies, continuing their significant yearly increase since 2021.

Yearly Comparison of Insolvency Types:

📈 Comparing June 2024 with the same month in the previous year reveals a notable increase. There’s been a 17% increase in insolvency cases, with June 2024 witnessing 345 more cases than June 2023.

Changes in Insolvency Types Year on Year:

- 🚫 Compulsory Liquidations: Increased by 19%

- 📈Creditors’ Voluntary Liquidations: Increased by 16%

- 🏢 Administrations: Increased by 22%

- 📄 Company Voluntary Arrangements: Increased by 64%

Month-on-Month Comparison:

Company insolvency numbers in June 2024 were higher than in May 2024.

📅 In June 2024, there was an 16% increase in insolvency cases compared to May 2024, marking a significant increase of 321 cases.

Month-on-Month Changes in Insolvency Types (May to June Comparison):

- 🚫 Compulsory Liquidations: Increased by 10%

- 📈 Creditors’ Voluntary Liquidations: Increased by 16%

- 🏢 Administrations: Increased by 30%

- 📄 Company Voluntary Arrangements: Increased by 21%

🔍 We encourage all credit management teams across the industry to stay vigilant and seek out the most valuable tools and information available. To learn more about how we can help you minimise risk and maximise cash flow, call in to speak with one of our experts today on 📞 01527 518800.

What is a Notice of Intention and What Does it Mean for Creditors?

What is a Notice of Intention?

A Notice of Intention (NOI) is filed either by a company, its directors or a floating charge holder (usually a bank) outlining that they wish to enter the company into Administration if an immediate solution to the company’s financial problems cannot be found. The notice which is filed at court contains details of the intended insolvency practitioners should the company enter into administration.

How does this affect the company’s creditors?

Once the notice has been filed, a protective dome (Moratorium) is placed over the company. This safeguards the company from any creditors wishing to take legal action, including issuing a Winding-up Petition, against the company in order to recover their overdue balance without express permission from the court. This can be a powerful tool for a company in financial distress as it provides a breathing space to allow them time to resolve the company’s financial situation, for example selling part of or all of the company to raise funds or to find a licensed insolvency practitioner to handle the Administration proceedings.

How long does the Notice of Intention last?

This moratorium lasts for 10 business days. It is possible for the company to apply for an extension and gain an additional 10 business days, as long as the court deems the extension in favour of the creditors and that the moratorium is not being abused for the companies benefit, for example, avoiding legal action taken by creditors.

Once the Notice of Intention expires and provided that no additional notice of intention or appointment has been filed, a creditor can continue to take legal action. It is worth noting however, that the company may not have the funds to pay the full balance owed and this should be taken into consideration.

When can’t a notice of intention be filed?

A Notice of Intention cannot be filed if the company has entered into Administration within the last 12 months or a Winding-up Petition has already been filed against the company.

Are there any disadvantages for the company?

The Notice of Intention is a very public event and can damage the company’s reputation and its ability to continue trading with suppliers and clients who are aware of the notice and therefore the company’s financial difficulties.

How Can Top Service help?

Our team of credit management experts has its ears to the ground and collectively possesses hundreds of years of knowledge and experience. It is our industry expertise that enables our team to swiftly respond to changes in trading patterns and address rumours and concerns within the construction sector, minimising your risk of bad debt. To learn more about our prevention services, give Top Service a call at 01527 518800.

Top Service Appoints Philip King FCICM as Non-Exec Director

We are thrilled to announce the appointment of Philip King FCICM as a Non-Executive Director at Top Service, effective July 1st.

Philip brings a wealth of experience in the credit management industry. After starting his career in the construction sector, Philip spent 14 years as Chief Executive of the Chartered Institute of Credit Management, and 18 months as the interim UK Small Business Commissioner. His expertise will be invaluable as we focus on building our brand, raising our profile, and growing our established business to become the preferred supplier of credit information and debt recovery services for the UK construction industry.

Emma Reilly CEO, shared, “It’s an absolute pleasure to welcome Philip to Top Service. After meeting him through his work with the CICM and engaging in numerous conversations, it became clear that we share a passion for credit management and supporting the industry in recognising its vital role in every business.”

Emma continued “With Philip’s appointment, we are poised to achieve our vision and further strengthen our position in the market, delivering exceptional value to our members and the wider UK construction & credit management industry”.

Philip King on his appointment “I’m delighted to be joining Top Service to work with their excellent team who deliver services of the highest quality to credit professionals in the challenging construction sector. I’ve been advocating the importance of good credit management throughout my career, and this is as true today as it has ever been. I’m looking forward to using my experience, and the lessons I’ve learned over many years, to help them enhance the profile they’ve established over the past 30 years.”

Exciting news!

We’re thrilled to unveil our new logo, marking a significant milestone in our journey. This refresh represents our commitment to innovation and growth in the UK construction and credit management sector.

Behind the scenes, we’ve been diligently preparing to realise our vision and solidify our market position. Our focus remains on delivering unparalleled value to our members and the industry at large.

This new visual identity illustrates our dedication to progress and excellence & ensures it is clear what we achieve for our members. Supporting construction businesses to minimise debt & maximise cash.

Stay tuned for more updates as we continue our business journey and strive to be the go to credit information and debt recovery service provider for the UK construction industry.

📊 Insolvency Statistics Update – May 2024

The Insolvency Service has released the latest figures for May 2024, providing a comprehensive overview of the insolvency landscape in the UK.

Company insolvency dropped 6% compared to April 2024 but insolvency remains higher than those seen during Covid-19 and between 2014 – 2019.

📈 Overview of Registered Company Insolvencies

In May 2024, a total of 2,006 company insolvencies were recorded. The breakdown is as follows:

- 📉 1,590 Creditors’ Voluntary Liquidations (CVLs)

- 🚫 271 Compulsory Liquidations

- 🏢 126 Administrations

- 📄 19 Company Voluntary Arrangements (CVAs)

📅 Yearly Comparison: May 2024 vs. May 2023

When comparing May 2024 to the same month in the previous year, a significant trend emerges. There has been a 21% decrease in the total number of insolvencies, with May 2024 witnessing 541 fewer cases than May 2023.

📊 Changes in Insolvency Types Year-on-Year:

- 🚫 Compulsory Liquidations: Increased by 27%

- 📉 Creditors’ Voluntary Liquidations: Decreased by 26%

- 🏢 Administrations: Decreased by 20%

- 📄 Company Voluntary Arrangements: Decreased by 37%

This yearly comparison indicates a mixed trend in insolvency types. While compulsory liquidations have surged, other types of insolvencies have notably decreased.

📆 Month-on-Month Comparison: April 2024 vs. May 2024

Examining the month-on-month data reveals a slight decrease in insolvency cases from April to May 2024. Specifically, there was a 6% decrease, equating to 138 fewer cases in May compared to April.

📉 Month-on-Month Changes in Insolvency Types:

- 🚫 Compulsory Liquidations: Decreased by 10%

- 📉 Creditors’ Voluntary Liquidations: Decreased by 5%

- 🏢 Administrations: Decreased by 13%

- 📄 Company Voluntary Arrangements: Increased by 6%

UK construction insolvencies remain at elevated levels but there are signs the numbers are beginning to level out, demonstrating the industry’s resilience & adaptability

The fact remains that credit management teams across the industry must remain vigilant and continue to look for the most valuable tools and information available to them. To understand more about how we can help you minimise risk and maximise cash flow, call in to speak with one of our experts today on 01527 518800.